How to Manage Credit Memo in QuickBooks Online: A Complete Guide

While most bankers are skilled and proficient at formatting and arranging the layout of the credit memo, we would like to share our top recommendations for bankers for drafting better credit memos. These recommendations are not related to underwriting or credit analysis, but rather on the general content, style, and layout of the effective credit memo. It’s a document that increases the amount due for a customer, typically because of underbilling, additional charges, or adjustments to previous transactions. Setting up clear internal workflows will ensure that credit memos are processed and approved accurately and efficiently.

Payments

Discounts or promotional adjustments must sometimes be applied after an invoice has been sent. Getting a credit memo means your account balance will go down because you owe less money to the company now. Companies use credit memos when they need to return money to a customer, like if something was wrong with their order.

- All the above data are very important for the transaction, because it helps the seller track what and how much has been sold and what is the current inventory status.

- By doing so and observing principles in relation to issues of credit invoices, you will subdue any problems that may arise regarding the usage of credit memos on your clients.

- This mechanism ensures the buyer receives the promised financial benefit without necessitating a full re-invoicing.

- A credit memo reduces what a customer owes after an invoice; a debit memo increases it.

- Credit memos reduce the amount a buyer owes by providing a credit toward future purchases or correcting invoice errors.

- Cash flow, or earnings before interest expense, taxes, depreciation, and amortization (EBITDA), should be calculated and documented based on the past 3-5 years of tax returns or financial statements.

Recordkeeping requirements

The necessity to explain why you expect the issuance of credit memo or credit invoices should also be emphasized because it addresses the question of any future queries. Further, whether due to returned goods, regarded as such, price modification, or credit on account of a promotion, a clear statement as to why a credit note has been issued is provided. By providing such explanations where necessary, it will reduce misunderstandings and assist you in preparing your financial reports. In day-to-day business operations, financial adjustments are often necessary. Whether due to a product return, an overcharge, or a discount, companies need a formal way to update customer balances.

Steps to Reduce Cybersecurity Risk in Automated Accounting

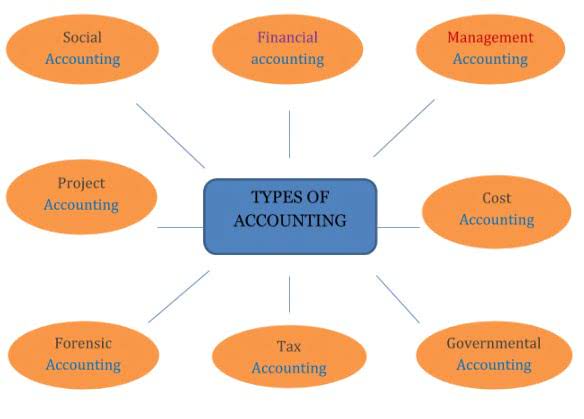

A credit memo, short for credit memorandum, is when a seller of goods or services issues a document to a buyer reducing the amount owed by the buyer further to the issuance of a past invoice. If the company issues the credit memo what does a credit memo look like for discount purposes, it can make the journal entry for credit memo by debiting the discount allowed account and crediting the accounts receivable. Sales returns and allowances account is a contra account to the sales revenue. Likewise, this journal entry will reduce both the net sales revenue on the income statement and the total assets on the balance sheet by the same amount.

Are Credit Tenant Loans Profitable?

The lower the LTV/LTC ratio, the more skin the borrower has in the collateral, thus reducing credit risk. If the borrower has problems generating cash to service the loan in the future, do they have enough cash on hand to supplement income shortfalls? Cash and investments are noted on the most recent tax return or financial statement and total liquid assets at the time of approval. While credit memos can be issued in conjunction with refunds depending on the incident, issuing https://frenshi.online/outsourcing-accounting-in-switzerland-2026/ a credit memo alone does not automatically entail sending the customer’s money back.

Credit memo journal entry

Businesses will record information on most credit memos to keep track of essential transaction data. For example, a bank issuing a credit memo for a mortgage payment may record the customer’s name, branch, and account number. Their purpose is Cash Disbursement Journal to correct any sales situation that demands a reduction in the amount of goods or services sold previously.

Recent Comments